Date: 2 November 2022

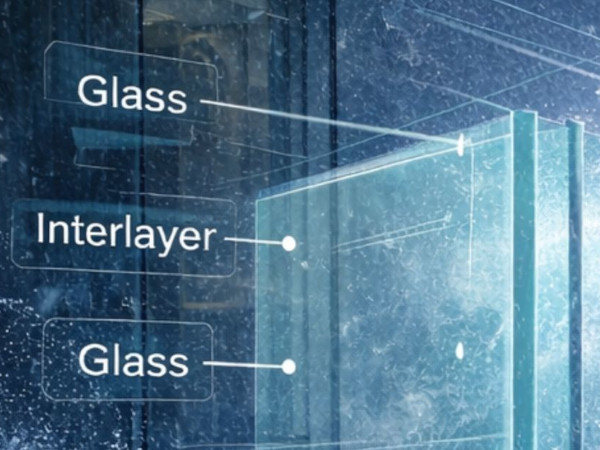

Truelink Capital ("Truelink") today announced its acquisition of Trulite Glass & Aluminum Solutions ("Trulite" or "the Company"), one of North America's largest architectural glass and aluminum fabricators, from an affiliate of Sun Capital Partners, Inc. Headquartered in Peachtree City, GA, Trulite fabricates and distributes a full suite of customized tempered, laminated, insulated and decorative glass as well as architectural aluminum from their 35 locations across the United States and Canada to a highly diversified customer base.

"Trulite has been on a journey to expand geographically, optimize operations and create a platform for scalability, which is a direct result of the hard work, persistence and determination of the Trulite team," said Kevin Yates, CEO of Trulite. "Upon our first meeting with Truelink, it was evident that they believe in our business, our potential and—most importantly—our people. The Truelink team brings a breadth of industry knowledge that will help us chart our path forward and continue to successfully execute on our strategic priorities. This milestone is a natural next step for our company, and we are confident that Truelink is the right partner as we work to unlock our next phase of growth."

"At Truelink, we are focused on helping companies adapt, meet the business challenges of today and thrive—and that is exactly how our firm intends to support Trulite," said Todd Golditch, Co-Founder and Managing Partner of Truelink. "Trulite is an industry leader, with an immensely talented team, experienced leadership and a strong customer value proposition. The Company has a solid foundation for growth, and we are enthusiastic about Trulite's high-quality products, high-touch service and ability to capture the opportunities that lie ahead. We are confident that, with additional investment, the Company is well-positioned to build upon its positive momentum and reach new heights in its next chapter."

This transaction marks the first acquisition for Truelink, which was launched earlier this year by Todd Golditch and Luke Myers to target companies in the industrials and tech-enabled services sectors. The firm's senior team brings decades of experience to their portfolio company partners, an extensive history of creating value together and well-established strategies to improve processes, fuel growth and enhance earnings.

Trulite will continue delivering the same high-quality products and solutions, supported by the Company's existing management team and its talented network of employees across the United States and Canada. The Truelink operations team is working together with Trulite leadership to make strategic investments in growing the Company, both organically and through strategic M&A.

Willkie Farr & Gallagher LLP, Alston & Bird LLP and Kirkland & Ellis LLP served as legal advisors to Truelink Capital.

Raymond James and William Blair served as financial advisors to Trulite for the transaction and Kirkland & Ellis LLP served as legal advisor.

600450

600450

Add new comment