Date: 11 February 2020

This release is a summary of Glaston Corporation's financial statements bulletin for 2019. The complete report is attached to this release as a pdf-file. The stock exchange release is also available on the company's website at the address www.glaston.net.

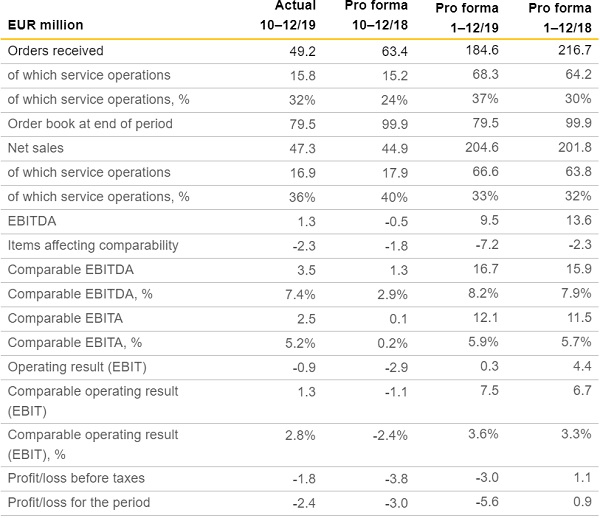

Glaston Corporation’s acquisition of Bystronic glass was completed on 1 April 2019. Glaston Corporation has prepared unaudited pro forma financial information to illustrate the impact of the Bystronic glass acquisition on the Group’s operational result and financial position and to improve the comparability of financial information.

The unaudited pro forma financial information for 2018 presented in these financial statements is presented as if the acquisition would have already been completed on 1 January 2018. Pro forma financial information has been titled Pro forma information in the places in the financial statements where the information is presented. The figures of these financial statements for the period 1 January – 31 March 2019 and the comparison data for period 1 January – 31 December 2018 do not include figures for Bystronic glass.

OCTOBER–DECEMBER 2019 IN BRIEF

• Orders received totaled EUR 49.2 (34.0) million.

• Net sales totaled EUR 47.3 (27.8) million.

• Comparable EBITA was EUR 2.5 (3.0) million, i.e. 5.2 (10.9)% of net sales.

• The comparable operating result (EBIT) was EUR 1.3 (2.6) million, i.e. 2.8 (9.2)% of net sales.

• Items affecting comparability totaled EUR -2.3 (-1.3) million.

• The operating result (EBIT) was EUR -0.9 (1.2) million.

• The comparable earnings per share were EUR -0.003 (0.043).

• Cash flow from operating activities was EUR 8.8 (4.6) million.

REVIEW PERIOD JANUARY–DECEMBER 2019 IN BRIEF

• Orders received totaled EUR 162.2 (107.6) million.

• The order book on 31 December 2019 was EUR 79.5 (38.2) million.

• Net sales totaled EUR 181.0 (101.1) million.

• Comparable EBITA was EUR 9.7 (7.6) million, i.e. 5.4 (7.5)% of net sales.

• The comparable operating result (EBIT) was EUR 5.9 (5.7) million, i.e. 3.3 (5.6)% of net sales.

• Items affecting comparability totaled EUR -7.2 (-1.8) million.

• The operating result (EBIT) was EUR -1.3 (3.8) million.

• The comparable earnings per share were EUR 0.011 (0.076).

• Cash flow from operating activities was EUR 10.8 (0.0) million.

• Net interest-bearing debt totaled EUR 33.0 (13.9) million.

• The Board of Directors proposes a capital repayment of EUR 0.02 (0.014 share-adjusted) per share

OCTOBER–DECEMBER 2019 IN BRIEF (comparables in brackets pro forma)

• Orders received totaled EUR 49.2 (63,4) million.

• Net sales totaled EUR 47.3 (44.9) million.

• Comparable EBITA was EUR 2.5 (0.1) million, i.e. 5.2 (0.2)% of net sales.

• The comparable operating result (EBIT) was EUR 1.3 (-1.1) million, i.e. 2.8 (-2.4)% of net sales.

• Items affecting comparability totaled EUR -2.3 (-1.8) million.

• The operating result (EBIT) was EUR -0.9 (-2.9) million.

PRO FORMA JANUARY–DECEMBER 2019 IN BRIEF

• Orders received totaled EUR 184.6 (216.7) million.

• The order book on 31 December 2019 was EUR 79.5 (99.9) million.

• Net sales totaled EUR 204.6 (201.8) million.

• Comparable EBITA was EUR 12.1 (11.5) million, i.e. 5.9 (5.7)% of net sales.

• The comparable operating result (EBIT) was EUR 7.5 (6.7) million, i.e. 3.6 (3.3)% of net sales.

• Items affecting comparability totaled EUR -7.2 (-2.3) million.

• The operating result (EBIT) was EUR 0.3 (4.4) million.

GLASTON’S OUTLOOK FOR 2020

Glaston Corporation expects that 2020 comparable pro forma EBITA will improve from the 2019 level (2019 comparable pro forma EBITA EUR 12.1 million).

PRESIDENT & CEO ARTO METSÄNEN: The need for energy-efficient solutions drives demand for insulating glass machines

“Climate change is one of the megatrends affecting Glaston and improving energy efficiency is strongly supporting demand for insulating glass equipment both in the USA and Europe. We have a strong market position and demand, particularly for Bystronic glass's TPSR (Thermo Plastic Spacer) technology, has been strong throughout the year. The technology, among other things, enhances the insulating glass production process and improves window quality and energy efficiency.

In contrast, challenges in heat treatment have continued and at the beginning of the fourth quarter we initiated measures to improve operational profitability. It now appears that the bottom has been reached in the EMEA area, with demand picking up in the final quarter after the previous quiet quarters. Orders received in the quarter for heat treatment machines were significantly below the busy Glasstec fourth quarter of 2018. The downturn in the automotive glass market also continued.

The Emerging Technologies unit received a significant order in the last quarter of the year. The project began as a development and engineering project for a US customer operating in the transportation and aviation industry. The engineering project was completed in the third quarter and it led to an equipment order in the fourth quarter. The order concerned a bending and tempering line for the production of complex shapes.

The project was made possible by the unit’s ability to meet the customer’s demands for high end-product quality and production efficiency. The product development of the Heliotrope project continues, and it is approaching a product that can be industrialized. Negotiations regarding the company’s near-term financing, in which Glaston didn’t participate, were concluded during the fourth quarter.

2019 was a significant year for Glaston through the acquisition of Bystronic glass and the integration of the company, and I would like to thank all of our employees for their contribution throughout the year. Despite market and other challenges, our pro forma net sales remained at the previous year’s level, while comparable (pro forma) EBITA improved in line with expectations.

I want to thank our customers for their trust in Glaston in 2019. The Bystronic glass acquisition was well received by our customers and we have had success in the cross selling of our products. The integration of Bystronic glass with Glaston has continued well and we have succeeded in combining our operations faster than expected. The planned integrations of operational functions have been completed, a new organization has been published and overlapping functions have been removed.

The measures already taken will result in annual cost savings of more than EUR 4 million. At the time of the acquisition, we estimated that we will achieve this level of savings by 2021. The merging of various IT and customer management systems, the integration of the Bystronic glass brand with Glaston, and the development of a common digital product platform, are the next steps in concluding the integration.

I would also like to thank our shareholders for your trust in 2019. The current year is equally significant for the company, as we celebrate our 150th anniversary. We will also continue to develop our business for the benefit of our customers by investing heavily in innovation and sustainability while enhancing our operating earnings performance.”

UNCERTAINTIES AND FACTORS AFFECTING NEAR FUTURE DEVELOPMENT

In the fourth quarter of 2019 uncertainty continued, particularly in the European heat treatment machines market, but a slight recovery in demand was apparent. Demand for insulating glass machines has continued to be good in all market areas and this is also expected to continue into 2020. Challenges remain in the automotive glass market and the same trend is expected to continue, at least in the short term.

The coronavirus epidemic that began in China at the end of 2019 is causing uncertainty for the market outlook and, if prolonged and extended, it might affect the company’s development.

Due to the project nature of the company’s business, the number of orders might fluctuate significantly from one quarter to the next, impacting the company’s net sales and earnings with a delay of approximately 3–6 months. The company’s after-sales services, which account for over 30% of the company’s net sales, are less cyclical and provide stability to the business.

GLASTON GROUP’S PRO FORMA KEY FIGURES

ANALYST AND PRESS MEETING

Glaston’s President and CEO Arto Metsänen and CFO Päivi Lindqvist will present the financial result to analysts, investors and media representatives on the same day at 14.30 at Pörssitalo, Fabianinkatu 14, 2nd floor,Helsinki. The meeting is held in Finnish.

The live webcast with the possibility for online questions can be joined through this link with the possibility of online questions. A recording of the meeting including the presentation will be available on the company’s internet pages www.glaston.net after the meeting.

600450

600450

Add new comment