Date: 27 February 2002

In the absence of any significant modification in the consolidation scope, the development in the results for FY 2001 compared with FY 2000 is as follows:

Consolidated sales amount to EUR 1,810.2 million. Despite a fall of around 3% in glass consumption in western Europe, this figure is up 7% under the combined effects of higher glass sales by the Group's three divisions, with increases of 6% for the Building Division, 10% for Automotive and 11% for Industries. These represent 55%, 27% and 17% respectively of the Group's sales.

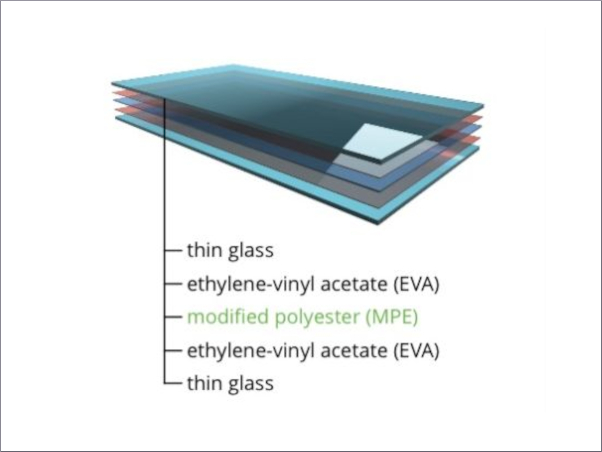

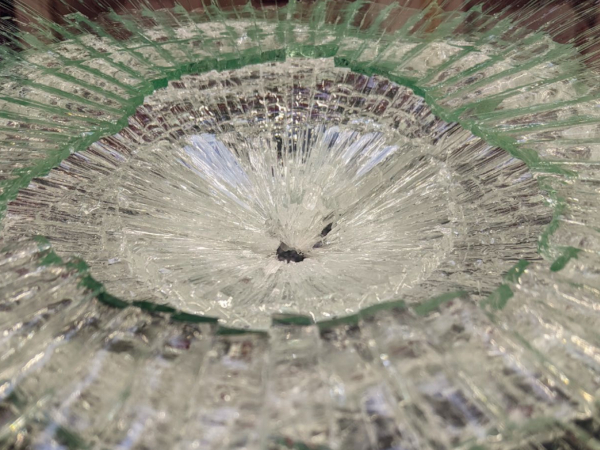

The Building Division owes its good performance mainly to new production capacity in the Czech Republic(superinsulating coated glass and laminated glass); expanding sales of products with high added value, such as the revolutionary new Sunergy hard-coated glass for insulation against heat and cold; favourable price for raw glass, despite a slight dip in the second half of the year.

The Automotive Division more than doubled its operating result, thanks to higher sales and a greater proportion of products with high added value (Iris solar control coated windshields), together with productivity gains achieved by the operational recovery plan introduced in 2000. This plan has achieved its first tangible results on the way to restoring profitability for the division as a whole, with the aim of achieving an EBIT/OCE ratio of 12% as of 2004.

The Industries Division continued to improve its overall performance, with its mirrors activity holding up well and with the beginnings of a recovery in the domestic appliance sector (Schott-Glaverbel joint venture). However it suffered the effects of technical problems and a four-week strike in Seneffe (BE). Other significant developments were the proportionate consolidation of the Fosbel joint venture (previously consolidated by the equity method) as result of the change in its shareholder structure.

The gross operating cash-flow has risen to EUR 385.4 million, an increase of 19%, and now represents 21% of sales.

The current gross result amounts to EUR 186.4 million, up by 35%, with net financial charges in line with the 2000 level. The Group's ratio of indebtedness has greatly improved, from 0.79 at the end of 2000 to 0.66 at the end of 2001, thus bringing it back to the level before the acquisition of PPG Glass Europe in 1998.

The net financial charges represent 2.7% of sales.

The net consolidated result (Group's share) comes to EUR 131.1 million, 31% higher than in 2000, after deducting the minority interests' share of EUR 7.8 million. This follows a 42% increase at the end of the first half year compared with the same period in 2000.

This amount includes net extraordinary charges that are more than double the 2000 level, at EUR 33.2 million. These comprise the cost of discounting the former early retirement schemes, the costs of productivity improvements planned in 2001 and 2002, various income and expenditure associated with restructuring of the Group's operational activities and further provision for the costs of implementing the recovery plans for the Automotive Division.

The net consolidated result further includes the results of companies accounted for by the equity method, amounting to EUR 9.5 million compared with EUR 4.4 million in 2000. This increase is due to the growing contribution by Bor Glassworks (RU), up from EUR 5.6 million in 2000 to EUR 9.2 million in 2001, thanks to investments in float glass production and the expansion of the local construction market.

The consolidated operating result (EBIT) has risen by 26%, to EUR 234.5 million. This increase is mainly due to the firming up of raw glass prices over the past two years, together with operational improvements in various glass processing sectors.

Add new comment