Date: 13 March 2013

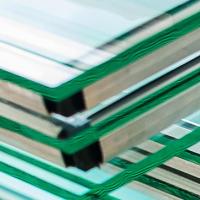

Restructure of ViridianCSR’s review of Viridian has concluded that, during the last few years, a sustained structural shift has occurred in the market for architectural glass products including: a persistently high Australian dollar that has put downward pressure on pricing, and has enabled alternative import supply chains to be established which are now expected to become a permanent feature of the glass market in the future; weaker residential and commercial construction markets are both at cyclical lows and are forecast to recover at a slower rate than previously anticipated; a significant increase in (downstream) processing glass capacity during a period of weak demand has adversely impacted the profitability and profit potential of the industry; and increasing energy and manufacturing costs in Australia have exacerbated Viridian’s competitive position relative to imports.“CSR is implementing a major restructure of its Viridian glass operations to reflect the reality of the market, improve the short-term performance of the business and position Viridian to compete successfully in the future,” said CSR Managing Director Rob Sindel.As part of the roll-out of the restructuring program, there are three changes to Viridian’s operations being announced today: The float and laminating glass manufacturing facility at Ingleburn in New South Wales will be closed in July 2013.The majority of volume previously supplied from Ingleburn will be supplied by Viridian’s Dandenong facility in Victoria and supplemented by imported supply from strategic partners.

CSR estimates the costs of redundancies, site relocation and site remediation costs will be approximately $34 million, the majority of which will be incurred in the financial year ending 31 March 2014. It is estimated that headcount reductions will be in the order of 150 which, when combined with site consolidation benefits, will deliver an annualised EBIT improvement of $27 million. Due to the extended time required to implement the restructuring program, it is expected that the full benefit of these initiatives will not be realised until the financial year ending 31 March 2015. CSR will be working with affected employees to provide redeployment opportunities within the company where possible.

Further details of the restructuring program will be announced when CSR presents its results for the year ending 31 March 2013. A review of the carrying value of the Viridian assets, including any resulting non-cash impairment, will be conducted as part of the financial year-end review process.

Viridian maintaining its leading market position

Once the facility closures are implemented, Viridian will have significantly reduced its cost of operations, while remaining the only fully integrated architectural glass processor in Australia. This will comprise the production of float glass at Dandenong and an extensive network of glass processing facilities located across Australia and New Zealand.

The Dandenong facility completed a major upgrade in 2008 and is a world class site with a market leading position providing enhanced customer service through specialised products, shorter lead times relative to imports and extensive product warranties which it can support as the only float glass manufacturer in the region. Viridian maintains its national footprint through an extensive distribution network which includes the unique Floatliner distribution system used throughout the east coast of Australia and recently extended to Western Australia. This system provides greater efficiency and improved customer service to its downstream customers and is a key point of differentiation in the market.

“Viridian remains a core part of CSR’s portfolio as it provides greater exposure to the commercial and multi-residential construction sectors and is aligned with many of CSR’s other products which enhance energy efficiency in homes and buildings” Mr Sindel said.

CSR trading update

While the Australian construction market has been difficult for some time, the outlook for residential construction appears to be improving modestly – particularly in New South Wales, Western Australia and Queensland. The rolling 12 month total of building approvals has increased steadily over the last six months to January 2013.

CSR's Building Products’ businesses continue to perform well in a challenging market. Earnings before interest and tax (EBIT) for Building Products are expected to be in the range of $75 to $78 million for the year ending 31 March 2013.

The structural changes in the architectural glass market noted earlier combined with the ongoing downturn in construction activity has had a more pronounced impact on Viridian which has led to an acceleration of operating losses since CSR’s half year results announcement in November 2012. CSR now anticipates Viridian’s loss before interest and tax (pre-significant items and restructuring costs) will be in the range of $37 to $39 million.

In Aluminium, prices have recovered by around 15% from the low of A$1,750 per tonne in August 2012, having recently stabilised at around the A$2,000 per tonne level. Ingot premiums have remained high and, for the current quarter, premiums were in excess of US$240 per tonne and appear likely to remain at or near these levels in the short to medium term. Hedging undertaken in the last two months combined with these relatively high ingot premiums has significantly improved the earnings in Aluminium for the second half (relative to first half) of this financial year. As a result, EBIT for Aluminium is expected to be in the range of $50 to $52 million.

As always, Property earnings are subject to the timing of completion of transactions. While there are two transactions nearing conclusion (EBIT impact of $6m), it is increasingly likely that these will be completed in the early part of the next financial year. Therefore, EBIT from Property is likely to be negligible for the current financial year. CSR’s medium term property pipeline remains robust with strong interest in the first stage of the Chirnside Park residential development in Melbourne which will benefit earnings in future years.

Group outlook

Due to the recent deterioration in performance of Viridian and the timing of Property sales, CSR now expects net profit after tax (pre-significant items and Viridian restructuring costs) for the 12 months ended 31 March 2013 to be in the range of $30 to $34 million.

Add new comment