Date: 18 February 2026

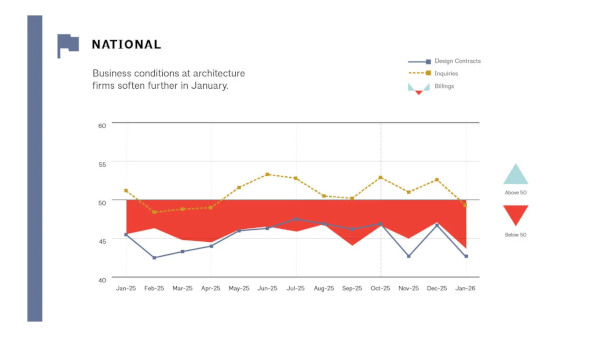

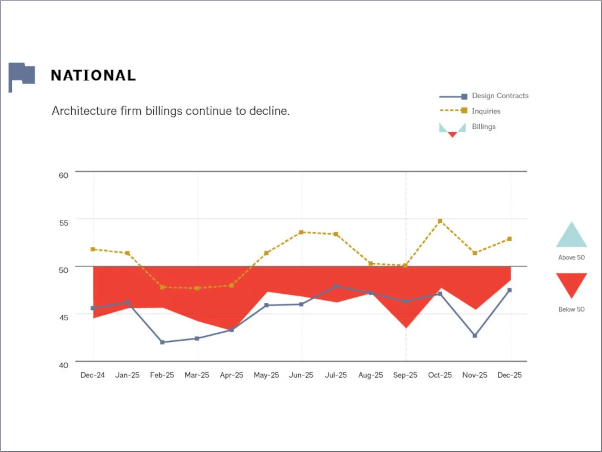

In January, inquiries for new projects dropped for the first time since April 2025, alongside a decline in newly signed design contracts, as client uncertainty persisted and new projects tended to be smaller in scale. Billings decreased across the country, except in the South, where they held steady. Firms in the Midwest, which saw growth in late 2025, are now experiencing declines again. Business conditions remained challenging across all specializations, with multifamily residential firms seeing a slower rate of decline but no billings growth since mid-2022.

"Overall economic conditions remain subdued, with revised 2025 employment data revealing smaller gains than anticipated and nonfarm payrolls increasing by just 130,000 in January 2026," said AIA Chief Economist, Richard Branch. "That said, construction employment was a bright spot, adding 33,000 jobs, including 25,000 in nonresidential specialty trades, signaling a positive shift after stagnant growth last year. Architectural services also showed resilience, with a net gain of 1,300 positions in 2025 despite early declines and a slight dip in December."

Key ABI highlights for January include:

• Regional averages: South (50.2); Midwest (46.3); West (46.3); Northeast (42.3)

• Sector index breakdown: multifamily residential (48.4); institutional (46.8); commercial/industrial (43.9); mixed practice (firms that do not have at least half of their billings in any one other category) (43.4)

• Project inquiries index: 49.3

• Design contracts index: 42.7

The regional and sector categories are calculated as three-month moving averages and may not always average out to the national score.

*Every January the AIA research department updates the seasonal factors used to calculate the ABI, resulting in a revision of recent ABI values.

Access resources to help architects successfully navigate an uncertain economy.

600450

600450

Add new comment