Date: 20 January 2014

Smart glass can be used in buildings and also in cars and trucks, which is our primary concern here.

Smart glass can provide a variety of capabilities for auto glass—self-tinting (a.k.a. self-dimming) windows, self-cleaning windows, self-repairing windows and enhanced in-car information and entertainment systems. In fact, smart glass has been providing functionality of this kind for many years, but has never shown signs of being much more than a tiny market niche within the huge auto glass sector.

Until very recently, the addressable market for smart auto glass has never seemed to extend much beyond luxury vehicles or (in a few cases) car enthusiasts who buy aftermarket products. And the low performance of many smart auto glass products makes it quite difficult for many smart auto glass products to penetrate to any great degree even the small addressable markets.

This rather pessimistic appraisal of the here and now for smart auto glass seems to contrast with the high level of interest that NanoMarkets is seeing in smart auto glass at major glass makers, electronics firms, and car companies. We think that this dichotomy can be explained by the fact that the potential for smart auto glass seems to fit into three key trends in the auto glass sector and in the auto industry more generally: cars and trucks becoming “smart objects,” improved fuel economy and response to environmental considerations, and changing design priorities.

In all three cases, the challenges to revenue are both technological and market oriented. The glass and coatings industry must find ways to improve the performance of smart auto glass. The car and truck makers must find ways to turn smart glass into buying points for customers. At present, the rush to install smart glass in the automotive sector is mainly on the supply side.

Automobiles, Glass and the Internet-of-Things

Automobiles are considered likely to become important nodes in the coming Internet-of-Things (IoT) by important players. For example, California and Nevada already have rules governing robotized autonomous driving. And the IEEE is designing standards for an on-board local area network (LAN) that operates at 1 Gbps.

Meanwhile, the role that glass will play in the automotive IoT is testified to by Corning’s promotional movie, “A Day in Glass,” which shows how new forms of glass will play a key role in the evolution of both homes and cars. As NanoMarkets sees it, there are three types of smart glass-related opportunities emerging from the automotive IoT:

Enhanced control of existing smart glass products. Some existing “smart” glass products actually respond to the environment in a dumb way! Thus, passive self-tinting glass, tints when the light is strong and becomes less tinted when conditions darken. In a car, one might want more control reflecting other comfort and safety requirements. Active self-tinting glass provides additional control with use of more sensors and systems management sub-systems.

Sensors and other devices embedded in glass. Heaters and antennas have been embedded in glass for many years. However, the emergence of vehicles as part of the IoT suggests that more complex devices will need to be embedded in glass in the future. For example, where auto glass serves in instrument displays and displays for entertainment sensors, there may be an opportunity to embed sensors for gestural control or various other kinds of electronics for heads-up displays, etc.

Opportunities for new kinds of display glass for smart auto systems. NanoMarkets anticipates new kinds of displays such as transparent, curved and flexible displays. The glass for these displays will not actually be smart. Rather, the opportunity will be for new kinds of display glass for enhanced intelligence in the car itself. Corning’s “A Day in Glass” implicitly emphasizes this kind of opportunity

All of these apparent opportunities should be seen in context. IoT is a concept that is getting a lot of airplay in technical circles, but is still not talked about much among the general public. In the best of worlds, IoT will become the key shaper for electronics over the coming decade – and smart glass will be able to leverage this trend to generate new business revenues.

But if the general public sees nothing to get excited about in IoT in cars – or in IoT more generally, the smart auto glass opportunities may not emerge. The bottom line here then is that betting smart glass opportunities on cars becoming smart objects is risky business!

Environment, Fuel Efficiency and Smart Glass

Another megatrend that creates opportunities for smart auto glass is the ongoing concern with fuel economy and environmental concerns more generally. Unlike the IOT trend, environmental and fuel efficiency considerations are not “risky.” They have been key to automotive technology and design for many years now, so it is easier to clearly identify smart glass opportunities stemming from this trend.

And there do seem to be a number of opportunities for smart glass that flow from environmental concerns. Some – at least – of these seem to be well understood. Others are just emerging:

Tinted glass cuts down on air conditioning use. Although environmental concerns have traditionally never been the main reason why tinted windows have been deployed in cars, they do have a cooling impact, meaning that the car A/C does not need to be used as much and this contributes both to reduced fuel usage and broader environmental requirements. Tinted windows have been around for decades, but self-tinting smart windows adds a whole new level of control and responsiveness to what one has associated with tinted glass using a retrofit film

Embedding heat and other sensors in windows. This can provide information to automotive heating and cooling systems that make for more efficient/environmentally friendly cars and trucks.

Photovoltaics integrated glass. This kind of integration has been talked about for many years, but has become a commercial reality in the past few. The potential here is high, since photovoltaics could run many auxiliary systems in the vehicle, including lighting, wiper blades and perhaps even heating and cooling to some extent. With a battery, PV glass could help provide some back-up power if needed.

It is tempting to see these trends as unstoppable, and—as noted above—the risks associated with this kind of smart glass are relatively low compared with smart glass products designed to capitalize on autos as a smart object.

However, caution is advised here. We note that much of the driving force behind fuel efficiency and environmental concerns in the automobile industry is driven by rising real prices for energy and this trend might change as the result of an economic downturn or because of the arrival of new technologies for extracting fuel or powering cars.

With the latter in mind, it is tempting to assume that many of the smart auto glass technologies that we talk about in this report are a good fit with electric and hybrid vehicles. However, it should be noted that, despite all the good publicity that environmentally friendly cars get, launching a new vehicle line can be expensive and difficult as Tesla, Fisker, and Coda and can testify.

Smart Glass, Comfort and Design Trends

But there is very little risk in using smart glass to enhance comfort or to fit in with the latest design trends and it seems to NanoMarkets that perhaps there is more here for smart auto glass makers to leverage than from the IoT or energy efficiency meme, even if style or comfort doesn’t get the focus from smart glass makers. A few areas in which we think that smart glass can make a difference from a comfort and design perspective include the following:

More glass may mean smarter glass. A long-term trend in auto design is to put more glass in vehicles relative to the size of the car; especially larger windshields. This is a positive trend for smart glass, because (1) more glass seems to imply the need for self-tinting glass to cut down on glare and overheating of the cabin and (2) with more glass as a proportion of surface area, designers are more likely to want to position smarts on or in glass. However, cars have been getting smaller over the years and this balances the “more glass” trend.

Smart glass adds to safer driving. Both self-cleaning glass and self-repairing glass can be sold as safety and aesthetic enhancers. The problem is that neither of these is ready for widespread applicability beyond a few aftermarket coatings that don’t last long on the vehicle and must be frequently renewed. As a footnote, we expect touch-sensors and (especially) gestural control sensors to be embedded in glass moving forward.

Differentiation: Designers have always seen—and presumably will always see—glazing as a crucial element in designs that differentiate vehicles in the marketplace. Smart auto glass can add functionality and “coolness” to vehicles in support of the need to differentiate.

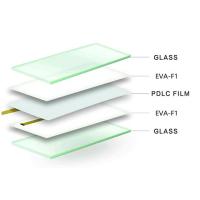

Privacy glass. Privacy windows are associated primarily with limousines and taxis, but the addressable market may be bigger than that. Self-tinting glass—especially PDLC glass—provides an upgrade on what is currently used and PDLC firms are targeting this market especially

Some sources on auto design suggest that car designers have lost their way somewhat in recent years. Perhaps this is because there have been so many changes in the car industry that design has somehow been forced to play second fiddle. As this balance is redressed, this may be an opportunity for smart glass.

Add new comment