Date: 26 February 2014

In addition, the report includes an eight-year (volume and value) forecast of smart auto glass with breakouts by materials technology and functionality.The report incorporates a technology assessment of the latest smart glass technologies for the automotive sector including self-tinting glass, self-cleaning glass, self-healing glass, and automotive display glass. Applications covered are windshields, mirrors, sunroofs, other automotive windows and dashboards. The report also discusses the glass-related opportunities that NanoMarkets sees emerging as the result of the latest trends in automotive infotainment systems.

This report pinpoints the main trends that will shape the revenue potential of smart auto glass in the next decade. Noting that many of the smart glass technologies used in cars and trucks have low performance and short lifetimes, this report analyzes how performance will be improved and how this can lead to enhanced revenue streams for the firms involved with smart auto glass, both as technology providers and as OEMs.

Finally, the report also discusses smart glass adoption strategies by the major automobile and light truck companies, along with the product, market and supply chain strategies of key firms that are shaping the market for smart auto.

TABLE OF CONTENTS

Executive Summary

E.1 Smart glass opportunities in the automotive industry

E.1.1 Self-tinting glass

E.1.2 Self-cleaning glass

E.1.3 Self-repairing glass

E.1.4 Smart auto mirrors

E.1.5 Information displays – device embedded glass

E.2 Eight companies that will shape the smart auto glass business

E.3 Current and future role for glass and coatings makers

E.4 The future aftermarket sales of smart glass products

E.5 Smart glass opportunities for the automakers

E.4 Summary of eight-year forecasts of smart auto glass

Chapter One Introduction

1.1 Background to this report

1.2 Objectives and scope of this report

1.3 Methodology of this report

1.4 Plan of this report

Chapter Two Assessment of Smart Glass Technologies for the Automotive Market

2.1 Self-tinting windows

2.1.1 Potential use of electrochromic windows in the automotive sector

2.1.2 Can SPD become the preferred technology for auto windows?

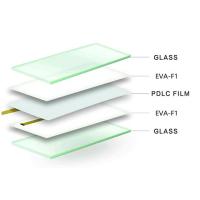

2.1.3 PDLC and privacy glass in autos

2.1.4 Thermochromic glass in the auto industry

2.1.5 Photochromic glass in the auto industry

2.2 Self-cleaning glass in the automotive sector

2.2.1 The end of the windshield wiper: an industry myth?

2.3 A future for self-repairing glass in the auto industry?

2.4 Dimmable mirrors and beyond?

2.5 Glass for embedded displays in cars

2.5.1 Glass for heads-up displays and augmented reality

2.5.2 Glass for dashboards, information displays and entertainment features

2.6 Multi-functional glass in the automotive market

2.7 Key points from this chapter

Chapter Three: Applications and Markets for Smart Glass in the Automotive Industry

3.1 Forecasts and forecasting methodology

3.1.1 Data Sources

3.1.2 Economic assumptions

3.2 Windshields

3.2.1 Key design trends impacting the use of smart glass

3.2.2 Key initiatives by leading automakers

3.2.3 Eight-year forecast of smart glass in windshields by type and functionality

3.3 Sun roofs

3.3.1 Key design trends impacting the use of smart glass

3.3.2 Key initiatives by leading automakers

3.3.3 Eight-year forecast of smart glass in sunroofs by type and functionality

3.4 Other windows

3.4.1 Eight-year forecast of smart glass in other windows by type and functionality

3.5 Dashboards, infotainment and other auto display applications

3.5.1 Smart glass enhancements for conventional dashboards and infotainment

3.5.2 Smart glass for heads-up displays and augmented reality in cars

3.5.3 Eight-year forecast of smart glass for auto display applications

3.6 Mirrors

3.6.1 Rearview mirrors – how Gentex has been so successful

3.6.2 Smart glass for other auto mirrors

3.6.3 Eight-year forecast of smart glass for auto mirror applications

3.7 Summary of eight-year forecasts of smart glass in automotive sector

3.7.1 Breakout by material/glass type

3.7.2 Breakout by type of functionality

3.8 Alternative scenarios

3.9 Key points from this chapter

Acronyms and abbreviations used in this report

About the author

Add new comment