Date: 20 October 2008

The salutary lesson, painfully learned, is that this must never happen again.

In a climate that has seen the banking community lose public confidence as never before, it’s hard not to have a sneaking admiration for Paul Newman, another victim of this tumultuous autumn, whose portrayal of a maverick robber made us secretly feel that it was no less than the banks deserved.

It’s a tribute to his acting genius that most of us are familiar with the exploits of Butch Cassidy and the Sundance Kid, the amiable rogues of the Hole in the Wall Gang who wise-cracked their way across the Americas, giving bank robbery a good name.

In fact, Butch Cassidy (real name Robert LeRoy Parker) and Harry Longabaugh (the Sundance Kid) and the rest of the Wild Bunch were responsible for numerous killings during their bank and train robbery careers.

Back then, at the turn of the 20th century, banks had little security and, in an age before fingerprints and surveillance cameras, the forces of law and order could often do little to track down offenders.

That’s all changed, with banks now having a range of passive and active systems to protect cash and staff – from high-definition cameras to ballistic barriers, and using automated solutions that prevent staff having access to the cash the bank robber wants.

Indeed, last year saw the lowest ever number of bank robberies recorded in the UK, according to the British Bankers’ Association – part of a continuing and steady decline in traditional counter robberies, with only 106 recorded incidents. Losses from robberies were also down £0.5 million in the year.

Bank robberies in the UK peaked in 1992, when there were more than 800 attacks. Since then, incidents have fallen as banks have tightened security procedures. In particular, panic alarms, changes to bank layouts and increasing use of closed circuit television have made it more difficult for criminals to get away with, literally, daylight robbery.

However, as technology has changed, so too has the threat – for example, from Trojan horses and computer worms that can spy on every keystroke we make either as companies or individuals. Police only recently foiled a plot to use a Trojan horse to steal £220 million from the London office of a Japanese bank.

However, low-tech or high-tech robbery isn’t the primary concern for today’s financial institutions. Leaving aside recent events, their main concern is to maintain the uninterrupted integrity of their information systems – the billions of bits and bytes on which financial markets depend.

In a modern financial institution, with millions of transactions being logged, analysed and processed every day, the commercial imperative is to maintain reliable data flows – 24/7 and across countries and time zones.

Information is a financial institution’s most important asset, and the protection of that asset is vital in maintaining trust between it and its customers, while ensuring compliance with the law, banking regulations and safeguarding its own reputation.

Nowadays, there are comprehensive regulations governing how financial institutions establish and maintain effective information security, continually integrating processes, people, and technology to mitigate risk in accordance with detailed risk assessments.

Those data protection strategies are all about identifying risks, establishing an approach to manage those risks, implementing the strategy, testing its implementation, and monitoring how risks and threats are evolving.

That aspect of evolution is crucial, because threats are no longer about system reliability or their robust ability to detect fraudulent or improper activity. A new human threat now has to be taken into consideration, and it doesn’t come from people who Butch Cassidy or Ronnie Biggs would recognise.

It comes, of course, from terrorism, whose purpose may simply be to disrupt. It’s an issue we had to address when we were approached by architects involved in the design of a new and commercially strategic HK$900 million (£62 million) financial data centre in Hong Kong.

The highly-sensitive building is HSBC’s main data hub for the entire Asia-Pacific region, processing financial transactions from banking operations across some 30 countries and territories and handling a variety of functions, including personal and business internet banking, securities trading, credit card, treasury and global payments.

Hong Kong architects Leigh & Orange were tasked with designing a building that would balance interior spaces filled with natural light with an exterior envelope able to withstand a spectrum of meteorological and man-made threats. Their design solution was to install glazing systems into the upper roof and roof top of the building – all of which had to meet stringent criteria for both blast performance and, in a typhoon region, severe wind loading.

The new data centre comprises three buildings of one to four storeys on a site of over 500,000 sq ft and in total represents a HK$2 billion investment by the HSBC Group. Underlining the centre’s strategic importance, HSBC Group income was HK$63,567 million in the first half this year, much of it generated in the Asia-Pacific region – and representing a huge amount of sensitive data.

However, so secure is the finished building that it is the first data centre in Hong Kong to meet the industry’s most stringent reliability and security requirements, a reflection of the changed threat facing major companies and organisations, and the importance of protecting both the occupants of sensitive buildings and the integrity of their information systems.

Nowhere is that dual requirement better exemplified than in a banking group’s central processing centre, where millions of financial transactions of regional importance to dozens of national economies take place every day. Safeguarding the integrity of that data against any form of interruption is absolutely vital in modern banking practice.

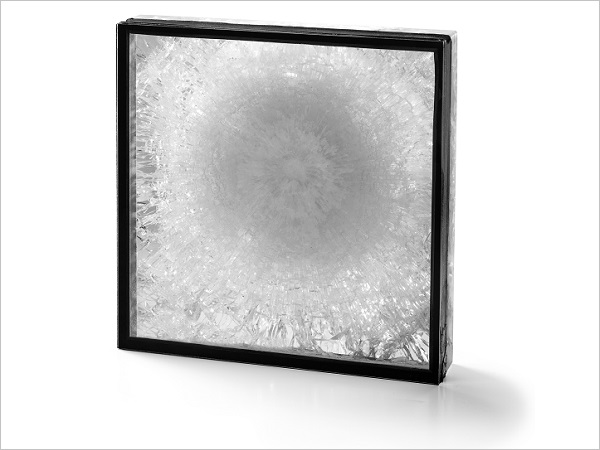

Our SG glazing system was used in vertical, horizontal and sloping light-well configurations, which allowed the architects to realise their design for interior spaces that were both secure and yet allowed for the maximum use of natural light.

The growing popularity of the SG system as a primary defence against terrorist attack is underlined by our commitment to conduct actual blast testing rather than simply carrying out computer simulations. That way, we know it will work.

Last year, at a specialist test site in the north of England, we successfully carried out a multi-panel lorry bomb test on the system – setting off a charge equivalent to 500 kilograms of TNT, and then coming in closer to the same test rig and setting off a simulated car bomb.

Most blast tests generally only simulate one size of charge and don’t involve two separate detonations. Most also use only a single module of glass, not a multi-panel large span assembly – guaranteeing our combined glass and framing system to ISO/DIS, GSA and ASTM standards.

It was a significant test because it pushed at the boundaries of what is possible with glass. It gives architects more scope to design buildings that are filled with light and therefore attractive to work in – while still making them safe and secure, both for its occupants and the information systems they support.

However, even with every technology at your disposal, a successful heist does sometimes still happen. The biggest robbery of all time took place in March 2003, the day before Coalition forces began bombing Baghdad. Nearly US $1 billion was stolen from the Central Bank of Iraq, with only about a half later recovered - found hidden in walls in (surprise, surprise) one of Saddam Hussein's palaces.

Mostly, however, threats to banks have come a long way since Butch Cassidy (and Saddam) rode off into the sunset. But, far from disappearing, it’s simply the nature of the threats that have changed - and which also underline how modern architecture coupled with new building products and systems can be crucial in meeting and mitigating against those threats.

As a new world financial order emerges, with tighter regulatory control, it will be the integrity of information flowing through the system that will ensure that chaos is never again allowed to happen. In that new world order, the built environment has an important role to play.

Ends

For further information:

Jane Embury, or Simon Bennett, Wrightstyle (for general media enquiries) +44 (0) 1380 722 239

jane.embury@wrightstyle.co.uk or simon.bennett@wrightstyle.co.uk

HSBC Data Centre Tseung Kwan O, Hong Kong

Project size: HK$900 million

Main Contractor: Hsin Chong Construction Group

Consultant: Meinhardt Ltd

Add new comment