Date: 11 April 2008

FY08 FULL YEAR HIGHLIGHTS

-- Revenues were $881.8 million, an increase of 13 percent compared to

the prior year.

-- Earnings from continuing operations were a record $1.49 per share,

up 33 percent from earnings of $1.12 per share a year ago.

-- Operating margin was 7.5 percent, compared to 6.1 percent the

prior year.

-- Architectural segment revenues were up 15 percent, and operating

income grew 33 percent compared to the prior year.

-- Operating margin was 6.7 percent, up from 5.8 percent the

prior year.

-- Large-scale optical segment revenues were flat as expected, and

operating income increased 51 percent versus the prior year.

-- Net earnings were $1.67 per share, compared to $1.12 per share last

year.

-- Earnings from discontinued operations were $0.18 per share,

compared to no earnings in fiscal 2007.

-- Guidance provided for fiscal 2009: earnings from continuing

operations are expected to range from $1.82 to $1.94 per share, which

would represent a 22 to 30 percent increase over fiscal 2008 results.

FY08 FOURTH QUARTER HIGHLIGHTS

-- Revenues of $243.3 million were up 18 percent from the prior-year

period.

-- Operating income was $22.5 million, up 66 percent from the prior-

year period.

-- Operating margin was 9.2 percent, compared to 6.6 percent in

the prior-year period.

-- Earnings from continuing operations were $0.49 per share versus

$0.32 per share a year earlier.

-- Fourth-quarter acquisition of Tubelite was neutral to

earnings per share.

-- Architectural segment revenues grew 21 percent, and operating

income increased 64 percent versus the prior-year period.

-- Large-scale optical segment revenues declined 9 percent as

expected, and operating income increased 33 percent versus the prior-

year period.

-- Net earnings, including discontinued operations, were $0.50 per

share versus $0.34 per share in the prior-year period.

Commentary

"Fiscal 2008 was another year of record earnings for Apogee," said Russell Huffer, Apogee chairman and chief executive officer. "We had strong operating income in both our architectural and large-scale optical segments." He added that both segments also had significant growth in fourth quarter earnings, with drivers for each of the segments consistent for the fourth quarter and full year.

"Our architectural segment has been operating well in markets that are using more and more value-added design and energy-efficient products," he said. "Project mix, pricing, high capacity utilization and productivity improvements contributed to our strong performance and improving operating margins.

"As we enter fiscal 2009, we are positioned for continued strong growth for our architectural segment," said Huffer. "We started the new year with our highest architectural backlog ever - $510.9 million. We have strong visibility for fiscal 2009 and into fiscal 2010 due to our backlog, project commitments, strong bidding activity and the construction levels and green building trends in markets we serve.

"Turning to the large-scale optical segment, earnings again benefited from an increased mix of our best value-added framing glass products," he said. "Although retail and picture framing market conditions softened during the year, we continue to convert framers to these great products.

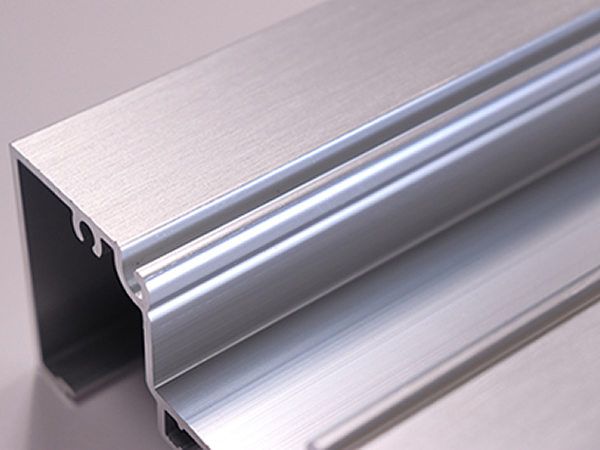

"We made two strategic moves in fiscal 2008 that began to contribute to growing our architectural segment," said Huffer. "In the fourth quarter, we acquired Tubelite, with annual revenues of approximately $60 million. Tubelite fabricates aluminum storefront, entrance and curtainwall products for the U.S. commercial construction industry, a large adjacent market we didn't previously serve. We also completed our exit of windshield manufacturing operations and have now converted that facility to serve our strongest business, architectural glass fabrication.

"In the fourth quarter, we repurchased approximately 339,000 shares at an average price of $15.96 per share, for a total of $5.4 million," Huffer added. "We hadn't repurchased shares for several quarters and felt it was an attractive investment."

Click on the link bellow to read the entire press release.

Add new comment